The protection under the Employment Act only applies to these categories of employees lets call them EA Employees. For example one employee monthly salarywage is 6000-per month and in any month 30days he worked 15days and avail 2 leave with wage and 4 woff then total pay days is 21days.

The 13th Month Salary In Belgium 2021 Updated Guide

Find the number of working days in the current month.

. 2 This Act shall apply to West Malaysia only. Salary Calculator Malaysia for HRMS Payroll System. Malaysias basic labour law for employers.

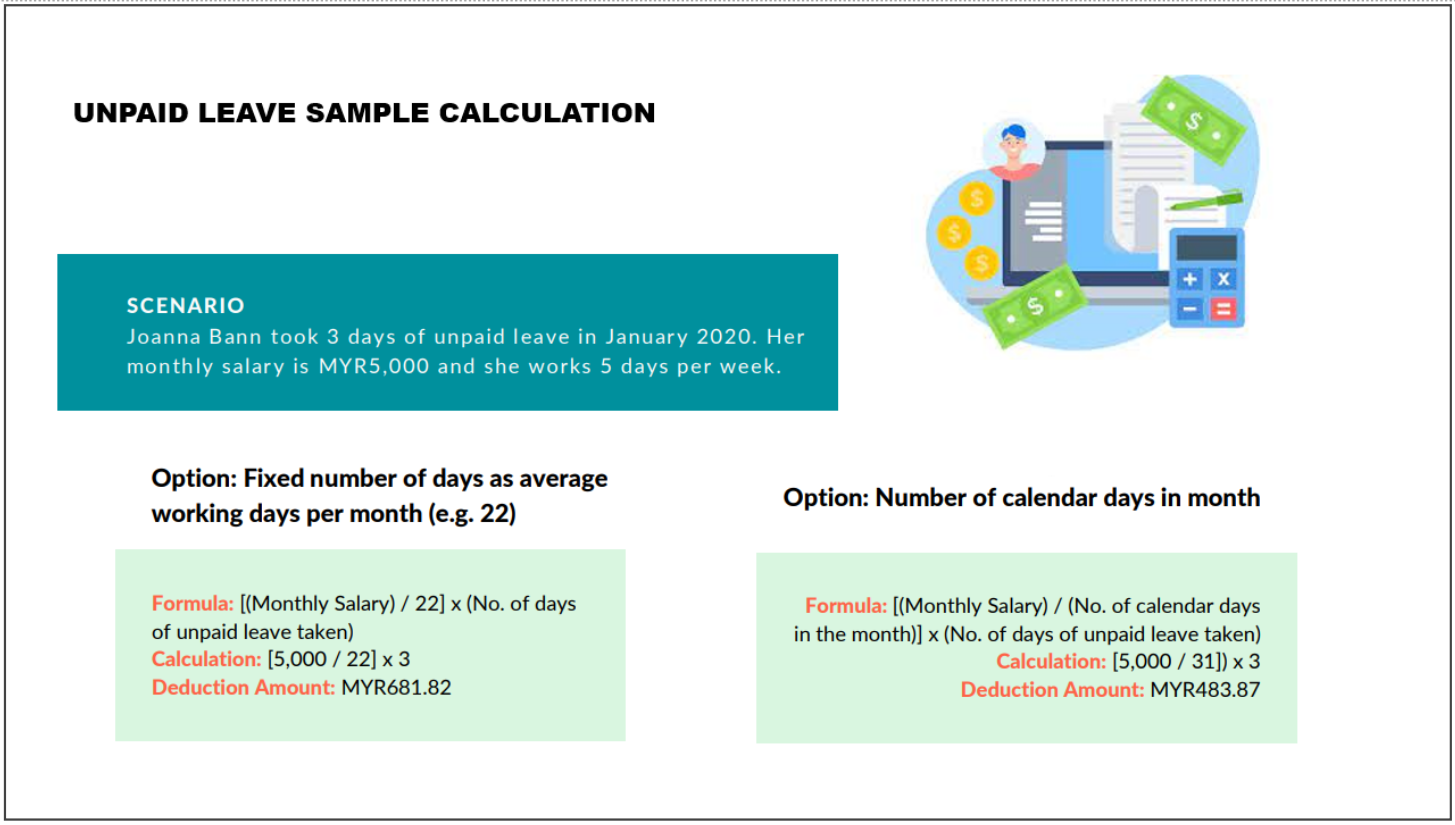

Manual calculation of unpaid leave. The employee daily-rated piece-rated and monthly-rated who works on a public holiday should be paid twice the ordinary rate of pay. Any employee as long as his month wages is less than RM200000 and.

RM 5500x 12 Calculation by percentage EPF Employee contribution. Now dividing by 26 days. Salary with fixed allowances X 12 months X years of services divided by 365 days.

Permanent residents ages below 60. More than RM 5000. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Malaysia tax calculator and change the Employment Income and Employment Expenses period.

Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020. The main purpose of EPF savings is for ones retirement this savings consists of the EPF contribution by employer and employee. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

Monthly Salary RM 1200 Normal Work Hours 8 Hours and. Basic salary rates for fresh graduates. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020.

Working period of 1- 2 years 10 days salary per year. Example work 10 days salary MYR2000. Divide the employees daily salary by the number of normal working hours per day.

Under Subsection 3 of Section 60D of the Employment Act 1955 -the prescribed rates for work. Overtime hours 3 hours. The standard practice for EPF contribution by employer and employee are.

Interpretation 1 In this Act unless the context otherwise requires --. RM 3000 RM 2500 RM 5500 EPF Employer contribution. Working period of more than 5 years 20 days of salary per year.

Payment for termination notice. The Malaysia tax calculator assumes this is your annual salary before tax. Overtime Hours on A Rest Day 3 Hours Not Exceeding Normal Work Hours Calculate the Ordinary Daily Rate by Dividing Monthly Salary RM 1200 By Working Days 26 RM 4615.

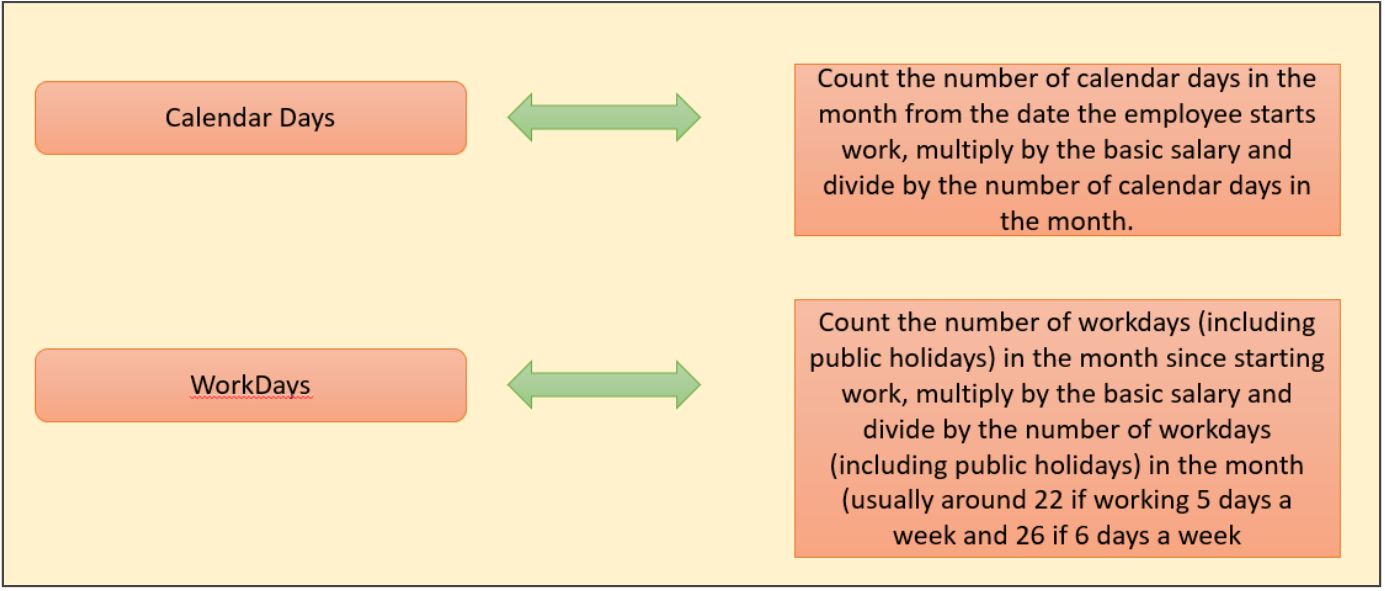

If the staff working full month it can be divided by 22 26 or calendar days. Normal Hourly Rate Monthly Salary Working Days per Month Working Hours per Day RM2600 26 8 RM1250. Residents ages below 60.

Monthly Salary x Number of Days employed in the month Number of days in the respective month. Now we calculate their salary by dividing 30days. What many people fail to realise is that the Employment Act does not apply to all employees.

The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -. 26 weekdays saturday.

The calculation of overtime in Malaysia is rather simple than the working and non-working days. An employee can claim the benefit to be paid as a lump sum if the permanent disablement is assessed to be 20 or less. 2000 1022 MYR 90910 -.

Short title and application 1 This Act may be cited as the Employment Act 1955. Paid salary6000- 600030 30-216000-20096000-18004200. RM 5500 x 11 see Third Annex The distribution is made on a monthly civil basis since the payment of the salary is contractually agreed monthly that the month has only 28 days as in February or 31 days as in.

Meanwhile you can calculate the daily wage of employees who are paid on a weekly basis by dividing the wage by 6 days. Residents ages 60 and above. So I think when you refer to number of working days in the month it is 22 days which benefited to the employee.

Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month. Employees whose monthly salary does not exceed RM2000. Where the permanent disablement is assessed to be 100 an employee will be paid a daily rate equivalent to 90 of the average assumed daily wage subject to a minimum daily rate of RM10.

The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay. Malaysia monthly salary after tax calculator 2022. The indemnity amount which has to pay is.

Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. 22 weekdays only. RM 5000 and below.

This is the amount of salary you are paid. For any overtime work during public holidays it should be computed as 15 x 3 x ordinary rate of pay. There are only two conditions to cater to.

How will you in-hand salary PF contribution change from July 1. New labour law. The apportionment is made on a calendar month basis because the salary payment is contracted on a monthly basis whether the month has only 28 days as in February or 31 days as in august the employee gets the agreed monthly salary.

Multiply this number by the total days of unpaid leave. An Act relating to employment. According to a report in 2019 Malaysian fresh graduates are earning an average of RM2635 a month.

Malaysias Labor Law on Normal Working Hours VS Overtime. Monthly rate of pay26 days. Significantly as the basic salary will be at least 50 per cent of.

For employees that are paid on a monthly basis you need to divide the monthly wage by 26 days. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. There is a 6 increase from 2018 which was RM2482 keeping up with inflation while helping companies attract the most qualified candidates.

A salary calculator Malaysia helps by simplifying the progress of employee salary calculation even based on the laws under employment act in Malaysia. Assuming EPF contributions are calculated the same way for ALL employees. For employees with monthly wages exceeding RM20000.

Any employee employed in manual work including artisan apprentice transport. Employees who are engaged in manual labour regardless of salary. The period of 4 weeks is from 1862015 to 1572015.

For each company whether it is process by monthly fortnightly weekly salary required a salary calculation method in order to process employee salary calculation. 1st June 1957 PART I - PRELIMINARY. Working period of 2- 5 years 15 days salary per year.

There is a tripartite body known as the National Wages Consultative Council which is formed.

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

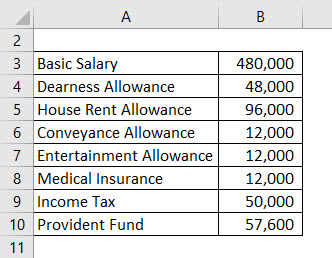

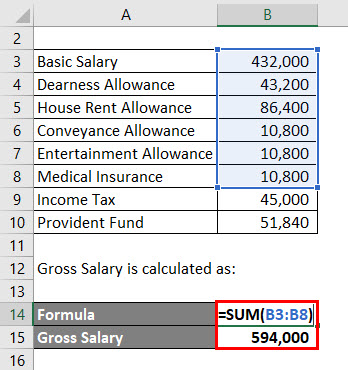

Salary Formula Calculate Salary Calculator Excel Template

Everything You Need To Know About Running Payroll In Malaysia

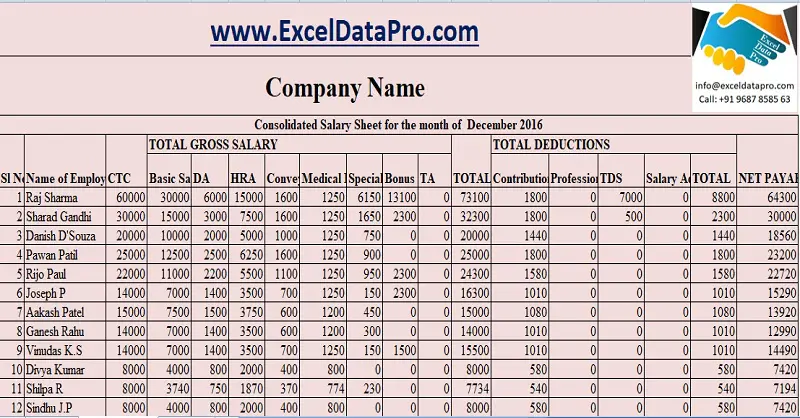

Download Salary Sheet Excel Template Exceldatapro

Salary Calculation Dna Hr Capital Sdn Bhd

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

What You Need To Know About Payroll In Malaysia

Salary Calculation Explained Monthly Payroll Formula Methods Youtube

Salary Formula Calculate Salary Calculator Excel Template

Payroll Journal Entries For Wages Accountingcoach

Everything You Need To Know About Running Payroll In Malaysia

Payroll Journal Entries For Wages Accountingcoach

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Best Payroll And Tax Services In Switzerland

Salary Formula Calculate Salary Calculator Excel Template

How To Do Payroll In Excel In 7 Steps Free Template